Save more with the same charges

in the same fund with the same investment

With the MPF Savings, the increase is based only on tax not being paid, with no additional funds being used.

How can MPF help you?

There are several ways that you can reduce your tax in Hong Kong: Rental Reimbursement / Home Loan, Charity, Educational Expenses and MPF. Paying into the MPF will help reduce your tax by offsetting the contribution against your income for Salary/Tax purposes.

This means that when compared to any other type of saving, you are not paying any tax on your MPF savings. This means that you can still pay the same amount into your savings (MPF) and it can give you up to 17% more to put into your account.

Hong Kong Tax System

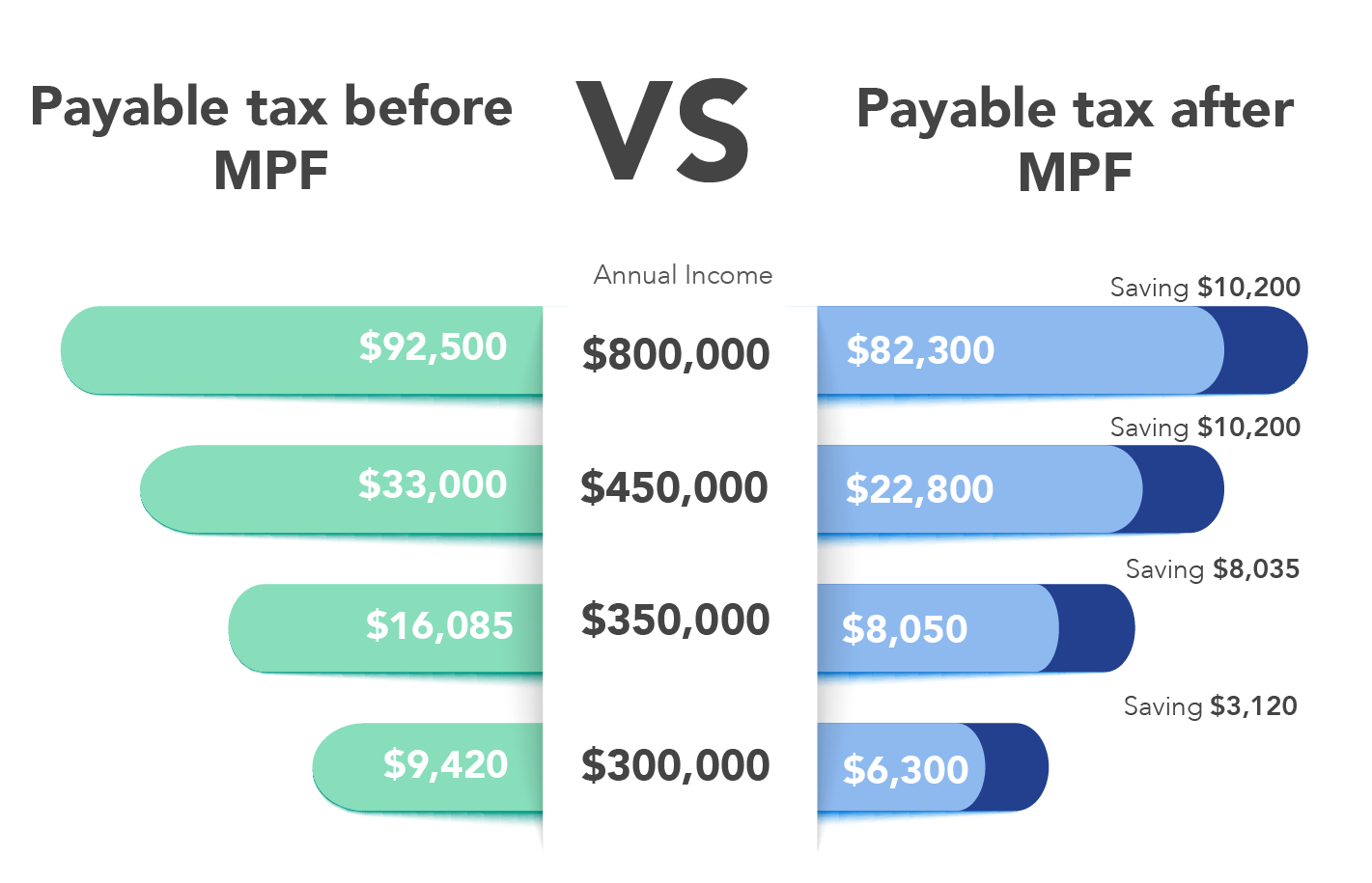

Below is a representation of the progressive salary tax on a yearly income. By utilising MPF savings, you are able to offset your income and reduce the payable tax.

First $50,000

$50,001 to $100,000

$100,001 to $150,000

$150,001 to $200,000

Over $200,001

With a personal allowance:

- Single Person pays 17% tax on income when they earn more than $28,000 per month

- Married Person with 2 children pay 17% tax on income when they earn more than $59,000 per month

A few ways to reduce your tax:

- Rental Reimbursement / Home loan

- Charity

- Education expenses

- MPF

Why use MPF to save?

More Control

Savings in your own account

Save Money

MPF Savings is considered a tax-effective way of saving

You Choose

You decide where it is invested

More Flexible

Can be taken earlier than age 65, on early retirement or when leaving Hong Kong

Don't Lose Out

Any other MPA accounts you have can be transferred into your own account

The Smart Choice

MPFA restricting the charges on the funds, so it is now better value and more inline with other savings

How much more money could I make?

For illustration purposes, below is a typical long-term saving you could expect to see using a savings out of taxed income:

Using the same investment growth, same fund charges, these figures could grow to the above figures (highlighted in blue) just from the tax saving available using your MPF account.

Download a summarising PDF

Click the button below to download a PDF document which summarises all the information detailed in this page. If you have found anything on this page interesting and would like to speak to one of our team, please fill out the contact form at the bottom of the page.

Additional details

How much can I pay?

You can pay a maximum to get tax relief of $60,000 per year

When can I get the money?

On retirement at age 65, early retirement from 60, when leaving Hong Kong, on incapacity

How easy is it to set up and claim?

Black Mountain can provide a simple form to start the extra payments

Contact the team today!

Fill in the form below and one of the team will get in touch with you ASAP to discuss how we can help you save money and reduce your tax contributions.