Employee Benefits Audit: The Complete Guide for Businesses

Employee Benefits Audit: The Complete Guide for Businesses

What is an Employee Benefits Audit?

An employee benefits audit is a structured review of your organisation’s benefits program. It evaluates whether your current benefits are:

-

Compliant with laws and regulations

-

Cost-effective and free from overspending

-

Competitive against industry benchmarks

-

Valued by employees and aligned with today’s workforce needs

In simple terms, an audit ensures your benefits are delivering maximum value for both employees and your business.

Why is an Employee Benefits Audit important?

1. Compliance and Risk Management

Employment laws are constantly evolving. An audit helps you:

-

Identify compliance gaps

-

Avoid legal and financial penalties

-

Strengthen governance across multiple regions

👉 For example, in the UK, employers are expected to follow Government guidance on employee benefits and expenses.

2. Cost Optimisation

Without a review, many businesses overspend on benefits. Audits highlight:

-

Under-used or duplicated benefits

-

Better-value alternatives

-

Savings opportunities without reducing employee support

3. Benchmarking and Competitiveness

Employees compare benefits packages. A benefits audit benchmarks your program against industry standards so you can:

-

Attract top talent

-

Improve retention

-

Stay competitive in your sector

👉 Organisations such as the CIPD regularly publish insights on employee benefits trends and best practices, making benchmarking even more powerful.

4. Employee Satisfaction

Benefits that are outdated or irrelevant won’t resonate with today’s workforce. Audits ensure your program matches what employees truly value.

The overlooked gap: Protecting your business, not just employees

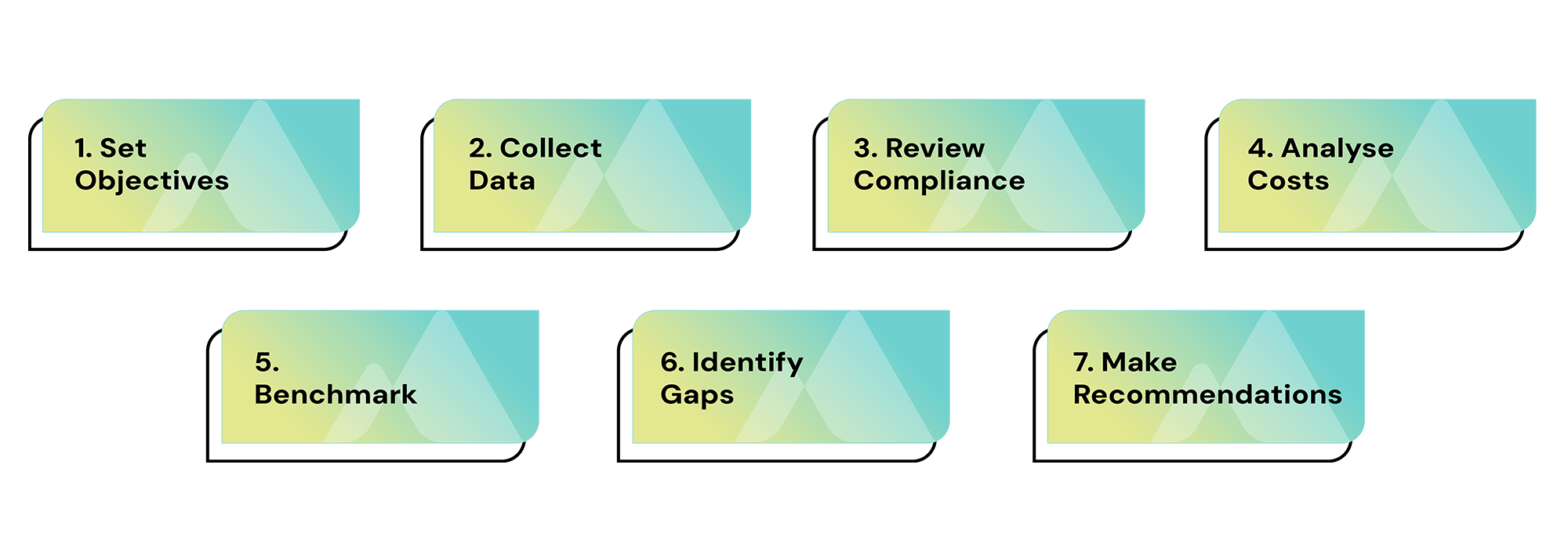

Follow these 7 steps for a structured review:

-

Set Objectives – Decide whether you’re focusing on compliance, costs, competitiveness, or all three.

-

Collect Data – Gather details on all benefits, costs, and usage.

-

Review Compliance – Assess alignment with local and global laws.

-

Analyse Costs – Identify overspending, under-utilisation, or duplication.

-

Benchmark – Compare against competitors and industry best practice.

-

Identify Gaps – Highlight where benefits aren’t meeting employee or business needs.

-

Make Recommendations – Build an action plan for optimisation.

Benefits of partnering with experts

At Black Mountain Employee Benefits (BMEB), we specialise in helping businesses of all sizes review and improve their benefits programs. Our audits provide:

-

Comprehensive analysis of benefits, compliance, and costs

-

Tailored recommendations aligned with your structure and goals

-

Risk management through solutions like Key Person Protection

-

Benchmarking insights so you know exactly how you compare in your industry

Key Takeaways:

-

An employee benefits audit ensures your benefits are compliant, cost-efficient, and competitive.

-

Regular audits uncover hidden risks, savings, and opportunities.

-

Protecting employees isn’t enough — you must also protect the business with Key Person Protection.

-

Expert-led audits turn your benefits program into a strategic advantage.

FAQs about Employee Benefits Audits

1. How often should a company conduct a benefits audit?

Most businesses benefit from an audit every 1–2 years, or after significant organisational or regulatory changes.

2. Who should be included in a benefits audit?

All employee benefits, including health, retirement, life, disability, wellness programs, and risk management policies.

3. Can an audit save money?

Yes. Audits often identify under-used benefits, duplication, or more cost-effective alternatives that can reduce expenses without reducing employee value.

4. How is a benefits audit different from a standard review?

A review checks usage and costs, while an audit takes a deeper look at compliance, competitiveness, and long-term strategy.

5. What is Key Person Protection and why is it linked to benefits audits?

Key Person Protection is insurance for critical employees whose loss would directly impact the business. It often emerges as a blind spot during audits.

What are your next steps?

Is it time to review your benefits programme?

Speak to the experts at BMEB about arranging an Employee Benefits Audit and explore how to protect both your people and your business.

Phone: +44 (0)800 008 3036

Email: enquiries@blackmountainhr.com

Contact Form: www.blackmountainhr.com/contact

Learn More: www.blackmountainhr.com/services/employee-benefits

Black Mountain Employee Benefits Ltd (BMEB) is authorised and regulated by the Financial Conduct Authority (FCA). Our FCA firm reference number (FRN) is 1017568. These details can be checked on the Financial Services Register by visiting https://register.fca.org.uk. Registered in England and Wales under company registration number 15585056. Registered Office: Worting House, Basingstoke RG23 8PX. BMEB’s Information Commission Office (ICO) registration reference is ZB826184. Calls may be monitored and recorded for quality assurance purposes.