Payroll Compliance in the UK: How it’s Costing Your Business and How to Fix Them

Payroll compliance in the UK isn’t just about paying employees on time. It’s about meeting strict HMRC deadlines, using the right tax codes, and ensuring pension contributions are accurate. Even a small payroll error can quickly become a compliance issue, leading to fines, wasted admin hours, and frustrated employees.

Many businesses discover that managing payroll in-house takes more time and carries more risk than expected. That’s why more UK companies are turning to professional payroll services to stay compliant, reduce errors, and give employees confidence that their pay will always be right.

The True Cost of Payroll Errors in the UK

- Payroll errors don’t just inconvenience you team, they can hit your bottom line. Common mistakes include:

- Incorrect HMRC filings: Late or inaccurate submissions can lead to penalties and interest charges.

- Wrong tax codes or deductions: Employees may be overpaid or underpaid, requiring time-consuming corrections.

- Pension contribution mistakes: Failing to meet auto-enrolment obligations risks fines.

- Data entry errors: Even small mistakes can snowball into compliance issues.

A single payroll error can cost hours of staff time to fix and impact employee trust. Businesses that invest in proper payroll management save both money and stress.

How Payroll Compliance in the UK Prevents Costly Errors

Payroll compliance in the UK isn’t just a legal box to tick, it’s the difference between smooth operations and expensive mistakes. When compliance is managed properly, errors are caught early, and risk is minimised across your business.

Here’s how a payroll compliance focused approach helps:

- Up-to-date with legislation and HMRC rules

- UK payroll rules (PAYE, tax codes, National Insurance, auto-enrolment pensions) change frequently. A payroll compliance provider stays ahead of those changes, ensuring you always file correctly and avoid penalties.

- Automated systems with built-in compliance checks

Automation reduces human error. For example, systems can flag incorrect tax codes, late pension submissions, or missing HMRC deadlines – helping you maintain compliance without spending hours double checking/ - Accurate pension and auto-enrolment compliance

Ensuring contributions are calculated correctly and submitted on time is a big part of compliance in the UK. Any mistakes can lead to charges from The Pensions Regulator. A payroll compliance services makes sure this area is handled properly.

-

Reliable reporting and audit trails

To demonstrate compliance, you need clear, auditable records—when things were filed, who approved what, etc. This is vital if HMRC or pension regulators audit you. A compliance-oriented payroll provider ensures you have those records in place. -

Employee trust and retention

When your staff are paid accurately, on time, and according to regulation, it builds trust. Payroll compliance helps ensure that employees aren’t dealing with unexpected deductions or errors. Happy team = lower turnover, better morale.

Common Payroll Challenges UK Businesses Face

Even with careful internal processes, businesses often encounter:

- Evolving legislation: PAYE, IR35, and auto-enrolment rules change frequently.

- Complex pay structure: Bonuses, overtime, and benefits increase the chance of mistakes.

- Multi-location teams: Different regions may have unique compliance requirements.

A professional payroll service combines expert knowledge with automation to minimise errors and simplify compliance.

Fast, Compliant Payroll Onboarding in the UK

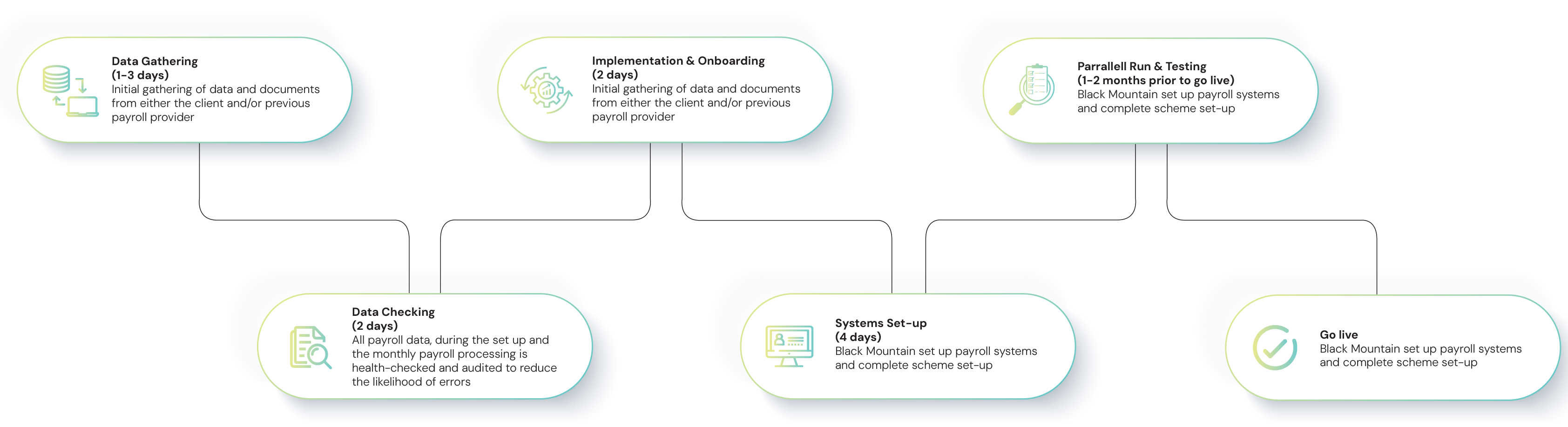

Switching payroll providers doesn’t have to be complicated or time consuming. With a structured approach, UK businesses can move to a fully compliant payroll system in as little as five working days.

Here is our UK payroll timeline that shows how quickly your business can go from sign-off to accurate, compliant payroll with Black Mountain.

Why Black Mountain Stands Out

- Clients who move their payroll to Black Mountain notice a “night-and-day” difference:

- Payroll is accurate every time.

- HMRC deadlines are never missed.

- Pension contributions are handled automatically.

- You get a dedicated UK payroll team who knows your business inside out.

With Black Mountain, payroll becomes a task you don’t have to think about, allowing you to focus on growing your business.

Steps to Achieve Error-Free Payroll

- Audit your current payroll process: Identify recurring mistakes or inefficiencies.

- Choose a trusted UK payroll provider: Look for compliance expertise and personalised support.

- Implement automation: Reduce human error while maintaining transparency.

- Monitor and optimise continuously: Ensure processes evolve with legislation and business growth.

To conclude payroll errors aren’t inevitable, they’re preventable. By partnering with a professional UK payroll provider like Black Mountain, you gain accuracy, compliance confidence, and happier employees.

Don’t let payroll mistakes cost your business time, money, or employee trust. Make the switch to expert UK payroll services today!

📧 Email us: enquiries@blackmountainhr.com

🖥️ Fill in our online form: www.blackmountainhr.com/contact

FAQ: Payroll Errors and UK Payroll Services

• What are the most common payroll errors in the UK?

Common payroll mistakes include incorrect tax codes, late HMRC submissions, mismanaged pension contributions, overtime or bonus calculation errors, and simple data entry mistakes. These errors can result in fines, lost time, and unhappy employees.

• How can payroll errors affect my business?

Payroll errors can cost your business in multiple ways: financial penalties from HMRC, wasted staff hours correcting mistakes, reduced employee trust and compliance risks related to pensions and PAYE obligations.

• What is a UK payroll service?

A UK payroll service manages employee pay, tax deductions, National Insurance, and pension contributions on your behalf. Professional providers ensure compliance with HMRC deadlines, reduce errors, and free up your internal team to focus on strategic taks.

• How do professional payroll services prevent mistakes?

Professional payroll providers use automated systems and expert teams to manage payroll. Automation reduces human error, while UK payroll specialists ensure compliance with tax codes, pension duties, and employment legislation.

• Can outsourcing payrolls save my business time and money?

Yes. Outsourcing payroll reduces the hours your team spends on manual processing, minimises costly errors, ensures compliance, and improves employee satisfaction, allowing your business to focus on growth and strategy.

• How do I choose the right UK payroll provider?

Look for a provider with proven experience in UK payroll, strong compliance knowledge, dedicated support teams, and automated systems that integrate with your existing HR or accounting processes.

• What makes Black Mountain different from other payroll providers?

Black Mountain combines UK payroll expertise with personalised service. Clients benefit from accurate payroll, automated pension contributions, HMRC compliance, and a dedicated team who understand their business inside out.